Ministry of Finance in association with RBI

- It aims to invest a part of physicals gold bars coins that are purchased every year into financial savings in the form of gold bonds.

- To buy the bond, investor has to pay issue price in cash to an authorised SEBI Brokar.

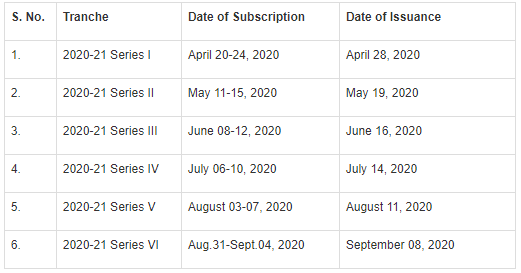

- The Government of India (GoI), in consultation with the Reserve Bank of India (RBI), has decided to issue Sovereign Gold Bonds (SGBs) in six installment, from April 2020 to September 2020.

- The series of Government-run gold bonds- the Sovereign Gold Bonds 2020-21 schemes- comes at a time when the rapid spread of the deadly coronavirus (Covid-19) has disturbed the financial market around the globe, but increase the appeal of the yellow metal (gold) as a safe -haven.

Gold Bonds

- The Gold Bond is an initiative taken by the Government of India in accordance with Reserve Bank of India.

- To reduce the demand of physical gold as the increasing import of gold is affecting the growth and investment of the country.

- A large amount of physical gold in the form of gold bars and coins are kept in every Indian household as savings.

- Sovereign Gold Bonds Scheme thus aims at investing these physical gold into financial savings through gold bonds.

- The tenure of these gold bonds is 8 year which can be cancelled prematurely after 5 year on interest payments dates.

- The Sovereign Gold Bonds Scheme was launched under the Gold Monetisation Scheme in the year 2015.

- The Gold Monetisation Scheme was introduced to replace the existing Gold Deposit Scheme (GDS), 1999.

- The scheme facilitates the gold dipositors to earn interest of 2.25% annually for a short-term deposit of one year to three year.

Eligibility for Gold bonds Scheme ?

- As per the Foreign Exchange Management Act, 1999 an individual bust be an Indian resident to meet the eligibility criteria under the Gold Bonds Scheme.

- Any individual/association/trusts/HUFs having an Indian residency is eligible to invest in a Sovereign Gold Bonds Scheme. They can also jointly invest in these gold bond as the eligible criteria of the scheme.

- The benefits of these scheme can also be availed by the minor provided this bond is purchased by the present on their behalf.

Benefits of Sovereign Gold Bond Scheme

The scheme provide flexible gold denomination in term of purchasing gold.

These gold bods are available in multiple weight denominations starting from 1 gram.

- The gold bonds can be availed either in paper or in demand from as per the convenience of an individual.

- The scheme also provides flexible investment where one can choose the amount he/she wants to invest.

- The interest provide for the gold bond is 2.50% per annum which can be paid semi-annually on the nominal value.

- Sovereign Gold Bonds Scheme has a tenure of 8 year which can be withdrawn prematurely after 5 year on interest payment dates.

- The gold bonds invested by the investor can be gifted or transferred to other who are eligible under the scheme. they can also trade these bonds on stock exchanges subject to notifications of the reserve bank of india.

- These gold bonds can be purchased through multiple payment modes such as cheques, cash, DDs or electronic transfer.

Difference between sovereign gold bond and gold monestisation scheme

- Under the gold monetisation scheme, individuals can deposit a minimum of 30 gram gold in bullion or in the form of jewellery with the ban for a year and real tax free interest.

- Under the sovereign bond scheme, gold bonds will be issued in rupees and dominated in 5 grams, 10 grams, 50 grams and hundred grams of gold.

- It aims to invest a part of physicals gold bars coins that are purchased every year into financial savings in the form of gold bonds.

- To buy the bond, investor has to pay issue price in cash to an authorised SEBI Brokar.

- The Government of India (GoI), in consultation with the Reserve Bank of India (RBI), has decided to issue Sovereign Gold Bonds (SGBs) in six installment, from April 2020 to September 2020.

- The series of Government-run gold bonds- the Sovereign Gold Bonds 2020-21 schemes- comes at a time when the rapid spread of the deadly coronavirus (Covid-19) has disturbed the financial market around the globe, but increase the appeal of the yellow metal (gold) as a safe -haven.

Gold Bonds

- The Gold Bond is an initiative taken by the Government of India in accordance with Reserve Bank of India.

- To reduce the demand of physical gold as the increasing import of gold is affecting the growth and investment of the country.

- A large amount of physical gold in the form of gold bars and coins are kept in every Indian household as savings.

- Sovereign Gold Bonds Scheme thus aims at investing these physical gold into financial savings through gold bonds.

- The tenure of these gold bonds is 8 year which can be cancelled prematurely after 5 year on interest payments dates.

- The Sovereign Gold Bonds Scheme was launched under the Gold Monetisation Scheme in the year 2015.

- The Gold Monetisation Scheme was introduced to replace the existing Gold Deposit Scheme (GDS), 1999.

- The scheme facilitates the gold dipositors to earn interest of 2.25% annually for a short-term deposit of one year to three year.

Eligibility for Gold bonds Scheme ?

The scheme provide flexible gold denomination in term of purchasing gold.

These gold bods are available in multiple weight denominations starting from 1 gram.

- As per the Foreign Exchange Management Act, 1999 an individual bust be an Indian resident to meet the eligibility criteria under the Gold Bonds Scheme.

- Any individual/association/trusts/HUFs having an Indian residency is eligible to invest in a Sovereign Gold Bonds Scheme. They can also jointly invest in these gold bond as the eligible criteria of the scheme.

- The benefits of these scheme can also be availed by the minor provided this bond is purchased by the present on their behalf.

The scheme provide flexible gold denomination in term of purchasing gold.

These gold bods are available in multiple weight denominations starting from 1 gram.

- The gold bonds can be availed either in paper or in demand from as per the convenience of an individual.

- The scheme also provides flexible investment where one can choose the amount he/she wants to invest.

- The interest provide for the gold bond is 2.50% per annum which can be paid semi-annually on the nominal value.

- Sovereign Gold Bonds Scheme has a tenure of 8 year which can be withdrawn prematurely after 5 year on interest payment dates.

- The gold bonds invested by the investor can be gifted or transferred to other who are eligible under the scheme. they can also trade these bonds on stock exchanges subject to notifications of the reserve bank of india.

- These gold bonds can be purchased through multiple payment modes such as cheques, cash, DDs or electronic transfer.

- Under the gold monetisation scheme, individuals can deposit a minimum of 30 gram gold in bullion or in the form of jewellery with the ban for a year and real tax free interest.

- Under the sovereign bond scheme, gold bonds will be issued in rupees and dominated in 5 grams, 10 grams, 50 grams and hundred grams of gold.

No comments:

Post a Comment